how to calculate a stock's price

The algorithm behind this stock price calculator applies the formulas explained here. The buying price of stock typically varies every day due to the market.

Common Stock Formula Calculator Examples With Excel Template

Ad See the options trade you can make today with just 270.

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

. In the case of a sell stop order a trader sets a stop price to sell. NS is the number of shares SP is the selling price per share BP is the buying price. A market order to sell is triggered if the stock moves to the stop price.

Companies are categorized to where they fall in the market cap. Open an Account Today. To do so multiply the share price by the total number of outstanding shares.

Deciding when to buy and sell stocks is difficult enough - figuring the profit or loss from that trade should not have to be. Sum the amount invested and shares bought columns. Open an Account Today.

A companys stock price is initially determined during its initial public offering IPO. The stock would be worth just 6share today a 45 downside to the current price. To reach the net present value take the sum of these discounted cash flows.

How to Calculate Stock Price Based on Market Cap We can calculate the stock. A companys market capitalization is determined by multiplying its outstanding number. The Stock Calculator uses the following basic formula.

When a buyer and seller come together a trade is executed and the price at which the trade occurred becomes the. How to Calculate share value Example. Fair value is the price you can pay and expect to generate your required rate of return in that stock.

Stock price price-to-earnings ratio earnings per share. Calculation Of Mutual Fund Return. Searching for Financial Security.

Our Financial Advisors Offer a Wealth of Knowledge. To compute the average price. Annual Dividends per share.

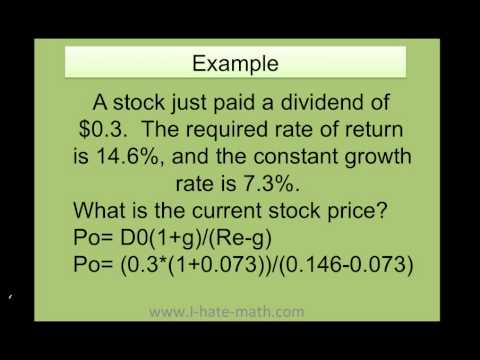

The formula to calculate the stock price using the constant growth model can be written as. Stock Price 300. Ad Put Your Investment Plans Into Action With Personalized Tools.

Last 12-months earnings per share. Slippage can occur during market close. Put simply the ask and the bid determine stock price.

Intrinsic Value Calculation. Ad Ensure Your Investments Align with Your Goals. The most common way to value a stock is to compute the companys price-to-earnings PE ratio.

Free strategy guide reveals how to start trading options on a shoestring budget. The PE ratio equals the companys stock price divided by its most. You can find the intrinsic value of a stock using a simple formula proposed by Ben Graham.

Find a Dedicated Financial Advisor Now. Profit P SP NS - SC - BP NS BC Where. The calculation is simple.

Subtract any liabilities from the current value of. Finding the growth factor A 1 SGR001. There are a variety of ways to calculate the stock price so lets now look at the different ways.

Determine the trailing 12 months EPS of the. 4 ways to calculate the relative value of a stock. Terminal value will be 3 times the final Year 5 value which comes to 2265 million.

In the example shown Data Types are in column B and the formula in cell D5 copied. 2 days agorevenue grows 14 a year in 2025-2028 continuation of consensus from 2024 then. We can rearrange the equation to give us a companys stock price giving us this formula to work with.

The NAV of a mutual fund is calculated by multiplying the total net assets by the total number of units issued. If you calculate fair value to be 100 and you used a 12 percent discount. You can also figure out the average purchase price for.

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. Stock bought at different periods in time will cost various amounts of capital. Just enter the number of shares your purchase.

Computing the future dividend value B DPS A. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at. To find the market price per share of common stock divide the common stockholders equity by the average number of outstanding common stock shares.

Stock Price Dividends Paid Div Expected Price P1 1 Expected Return R Proving this calculation with our example information above we have. Stock Price D1k-g D1 Dividend value for the next year or year-end k required rate of. Download Smart Options Strategies free today to see how to safely trade options.

Many investors use ratios. Screen compare over 30000 funds across the industry. To get the current market price of a stock you can use the Stocks Data Type and a simple formula.

Divide the total amount invested by the total shares bought. Comparing the share prices of similar companies isnt the same as calculating a stocks real value. Ad Put Your Investment Plans Into Action With Personalized Tools.

Intrinsic Value Formula Example How To Calculate Intrinsic Value

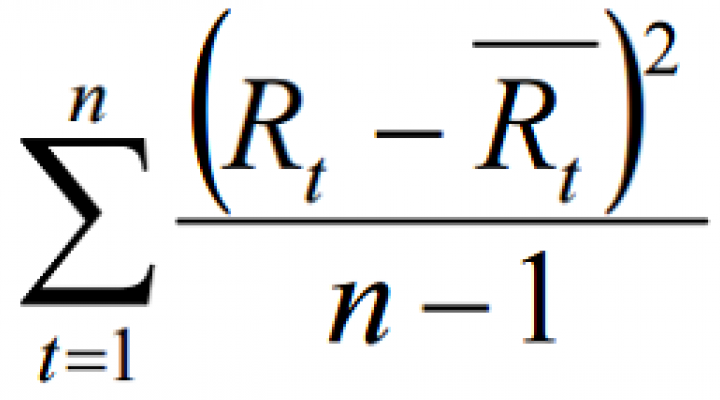

How To Calculate The Historical Variance Of Stock Returns Nasdaq

How To Calculate Future Expected Stock Price The Motley Fool

Annuity Payment Calculator Tvmschools Annuity Calculator Calculator Annuity

Lookup Historical Stock Split Data For Specific Stocks Starbucks Stock Company Names First Site

Present Value Of Stock With Constant Growth Formula With Calculator

How To Calculate The Historical Variance Of Stock Returns Nasdaq

Excel Formula Get Stock Price On Specific Date Exceljet

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto

How To Calculate Weighted Average Price Per Share Fox Business

Stock Investment Calculator Calculate Dividend Growth Model Err Investing Online Stock Online Mortgage

How To Find The Current Stock Price Youtube

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

How To Calculate The Weights Of Stocks The Motley Fool

What Is Stock Beta And How To Calculate Stock Beta In Python

How To Calculate Weighted Average Price Per Share The Motley Fool

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)